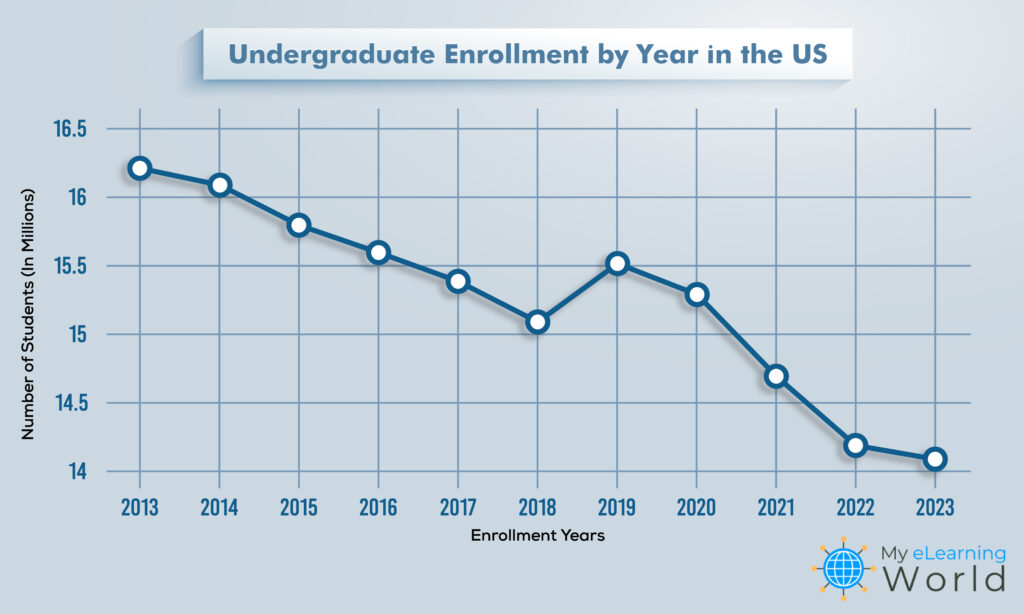

Whenever the topic of declining college enrollment comes up, the conversation inevitably turns to the pandemic being the source of the problem, but the reality is things have been trending downward for the past decade.

In 2013, there were 16,279,138 undergraduate students enrolled at American universities (this includes both two and four-year public and private institutions). Fast forward 10 years, and the most recent estimates from the National Student Clearinghouse Research Center show there are now only 14,187,588 enrolled undergrad students across the country. That’s a 12.8% drop of about 2.1 million undergraduate students over the last 10 years.

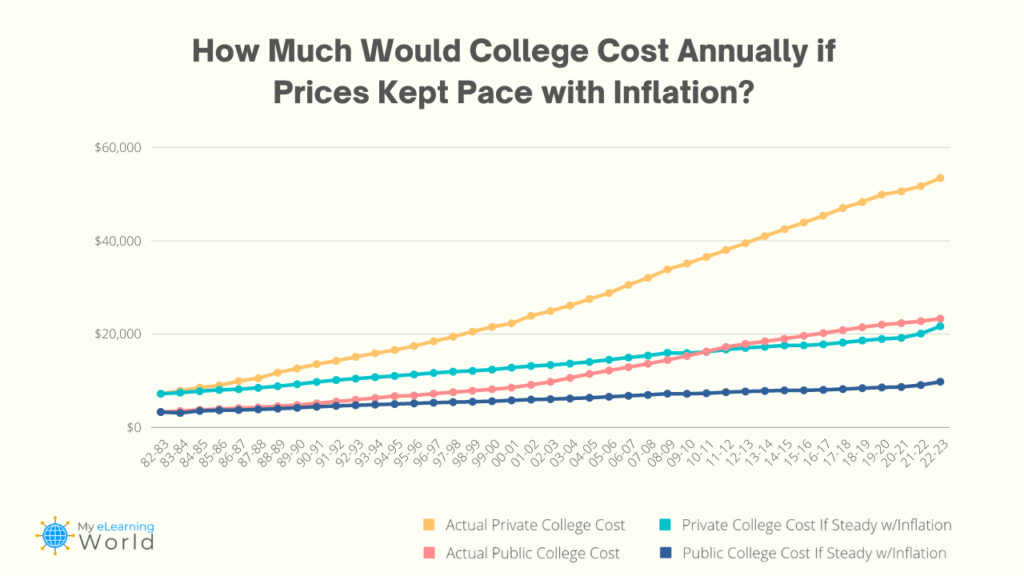

While there are numerous factors experts point to that impact college enrollment, from the COVID-19 pandemic to declining birth rates, the most common reason young adults say they’re skipping college is that it’s become too costly. As one of our previous reports revealed, the cost of going to college has outpaced the rate of inflation by about three times over the last 40 years.

Despite skyrocketing tuition fees, most studies show that the cost of college is worth it, offering students higher lifetime earnings and lower chances of experiencing unemployment.

With that in mind, what’s the potential economic impact of over 2 million adults declining to go to college over the last decade? After all, the data shows this represents a massive potential loss to these students’ future earnings which also could result in significant economic implications for the whole country.

Even though many of these “lost students” have skipped college for readily available jobs or to even start their own businesses right now, statistics show that unless they eventually go to school, they’re less likely to grow their earnings than their college-attending peers over time. As one recent report found, “Economists estimate that in 2031, the nation will have 171 million jobs. But only 30 percent of them will be open to workers without college degrees…Put another way, in 2031, 70 percent of workers with a college degree will have a good job, 40 percent of those with some post-high school education will have a good job and just 2 percent of those with a high school diploma will have a good job.”

So, what is the total potential economic impact of the declining college enrollment over the past decade?

We’ve run the numbers, and they’re shocking.

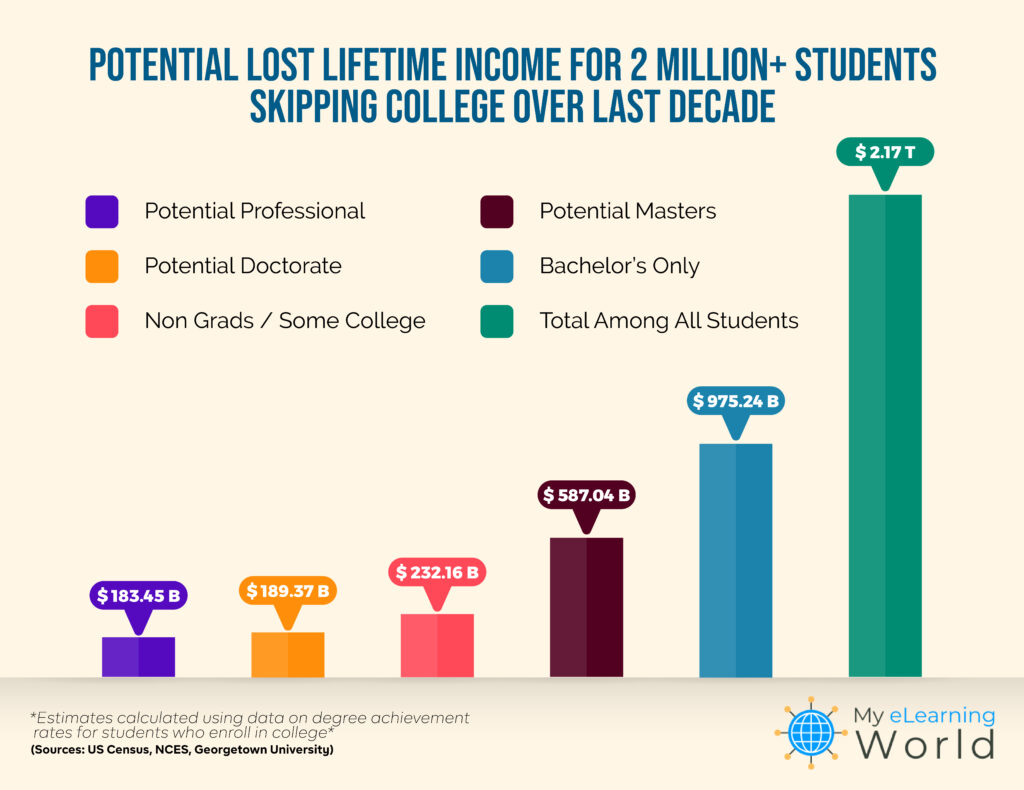

The total potential loss of lifetime earnings by the 2.1 million students skipping out of college since 2013 could exceed $2 trillion.

By The Numbers

How could the loss of 2,091,550 potential students result in over $2 trillion in lost income?

Here’s the breakdown:

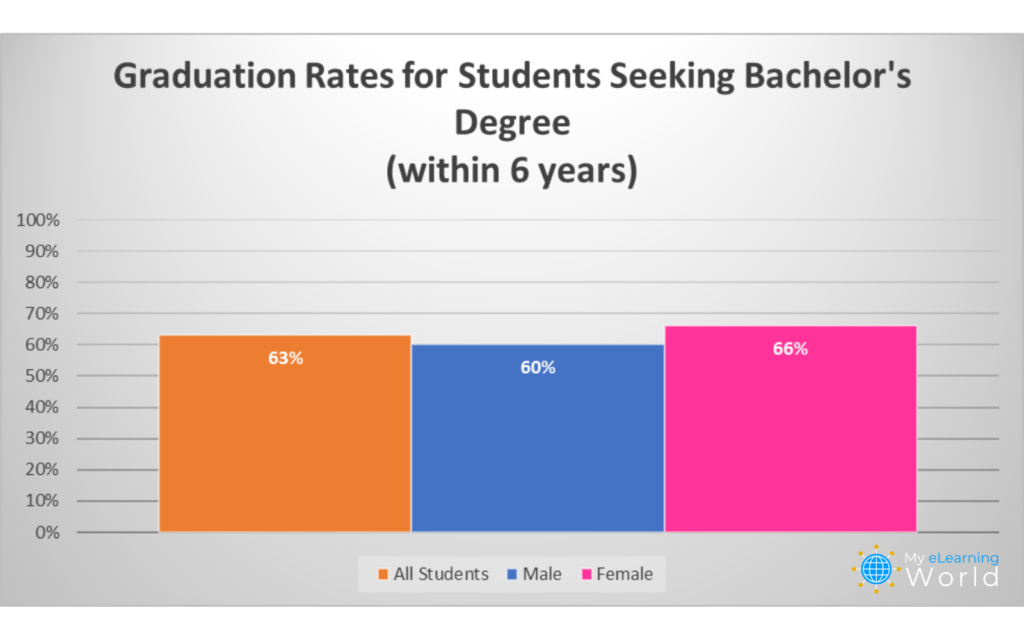

- Data from the National Center for Education Statistics shows that 63% of students who enroll in college end up getting at least a bachelor’s degree. This means that of the 2,091,550 lost students since 2013, we could have expected 1,317,677 to go on to receive at least a bachelor’s degree.

- Of those who earn a bachelor’s degree, US Census data shows that more than 27% will get a master’s degree, just under 6% will earn a doctoral degree, and about 4.5% will get a professional degree (Note: While the percentages presented are rounded for visual clarity and simplicity, all calculations that follow use exact, non-rounded figures to ensure accuracy in the large-scale computations.). Based on this information, of the 1,317,677 who would have earned a bachelor’s had they not skipped college during the last decade:

- 812,699 would have gotten just a bachelor’s

- 366,898 would have gotten a master’s

- 78,903 would have gotten a doctoral degree

- 59,177 would have gotten a professional degree

- Finally, that means the remaining 773,874 “lost students” would have failed to graduate, but would have completed some college before dropping out.

Now that we have identified likely potential educational outcomes for these students if they had chosen to attend college, we can figure out the economic impact of their decision to forego higher education.

A study by Georgetown University Center on Education and the Workforce calculated the average lifetime earnings of Americans based on their level of education:

- High school diploma – $1.6 million

- Some college, but no degree – $1.9 million ($300,000 more than those with a high school diploma only)

- Bachelor’s degree – $2.8 million ($1.2 million more than those with a high school diploma only)

- Master’s degree – $3.2 million ($1.6 million more than those with a high school diploma only)

- Doctoral degree – $4 million ($2.4 million more than those with a high school diploma only)

- Professional degree – $4.7 million ($3.1 million more than those with a high school diploma only)

With these numbers, we can now work out the potential dip in future earnings for these “lost students” over the past decade:

- Those who would have earned a bachelor’s degree only: $975,238,415,568.86

- Those who would have earned a master’s: $587,036,716,167.67

- Those who would have earned a doctoral degree: $189,366,682,634.73

- Those who would have earned a professional degree: $183,448,973,802.40

- Those who would have done “some college”: $232,162,050,000.00

Total potential lost lifetime earnings among all the lost students: $2,167,252,838,173.65

A Massive Economic Impact

With a staggering potential lost earnings of more than $2 trillion, the ripples from the college enrollment crisis seen over the last decade may be felt by the entire US economy in the coming years.

There’s a catch for these potential students who might be swapping their education for readily available low-skilled job opportunities at the moment — while they’re making money now instead of paying high tuition fees, they’re probably going to be anchored to their current wages for a good while.

In straightforward terms, workers pulling in higher wages give the economy, especially at a local level, a nice boost.

Tony Carnevale, the director of Georgetown University’s Center on Education and the Workforce, shared with NPR a pretty clear picture when discussing the potential ramifications of the college enrollment decline, “The direct loss to the economy is the workers themselves. If they were trained and ready, they would get higher-wage jobs and they would add more to GDP, making us all richer and increasing taxes, reducing welfare costs, crime costs, on and on.”

A slide in enrollment is also likely to result eventually in skill gaps, making the hunt for qualified workers a tougher game for businesses, potentially forcing many to close their doors over time.

Will Colleges Reverse the Trend?

The colossal economic implications of the shrinking college enrollment are complex, but the message rings clear – colleges have their work cut out in halting the decline and reclaiming students.

As mentioned earlier, the ticket price of college has skyrocketed at nearly three times the rate of general inflation over the past 40 years, causing many students to balk at the steep tuition fees.

The past couple of years have financially upended numerous Americans, leaving those most economically fragile unable to foot the bill for college. Even with financial aid in the picture, the value proposition is still questioned by a large portion of the population. A notable chunk of young adults is pivoting towards career training on online course websites like Coursera, edX, Udacity, and Udemy, which come without the hefty price tag (or the prestigious degree) of college.

The most impactful move would be to make college more wallet-friendly, making it less enticing for young adults to bypass education for immediate employment that manages the bills today, albeit perhaps not in the future.